Maximizing Public Benefits for Special Needs Adults Using ABLE Accounts in California

Setting up a California ABLE account supports the unique requirements of someone living with special needs without risking the loss of much-needed disability benefits.

Planning for the care of a loved one with special needs is one of the most compassionate and responsible decisions you can make. However, you recognize that you may not always be there regardless of your current age or health. The disabled person needs the appropriate level of support in place to live their best life both now and into the future. ABLE accounts are just one tool you have at your disposal.

Download our Guide to Special Needs Trusts

What is an ABLE account? What are the pros and cons of setting one up from your family member? Read on to see how to maximize benefits through an ABLE account in California.

What Is an ABLE Account?

An ABLE account is a specialized savings account designed for people with special needs who become disabled by 26 YO. It acts much like a traditional bank account. But it has several benefits explicitly designed to provide a capable person with a disability the designated funds they need to live as independently as possible.

The special needs adult sets up a regular bank account at their bank of choice. Then set up the ABLE account online and link it to that account. When the special needs adult deposits and withdraws money, the ABLE account tracks those transactions.

This type of account has several tax benefits that make it an appealing choice for special needs planning.

Along with a special needs trust, ABLE accounts are an essential financial tool you have to safeguard the future of your loved one with a disability. The owner of the account (the disabled person) can use these funds on anything disability-related. Qualified spending is actually generously broad, including even rent and utilities.

At Cookman Law, we love ABLE accounts. They both the independence they facilitate for those with special needs and the ease they add to family members supporting a loved one with a disability.

Learn more about estate planning for families with special needs children: Download our Guide to Special Needs Trusts.

What Is a CalABLE Account?

The ABLE Act of 2015 established ABLE accounts on the federal level. With that said, they’re not managed federally. Each state is responsible for managing them while following federal rules.

State-to-state rules vary slightly to meet the needs of residents in that location. An ABLE account in California is known as a CalABLE Account.

Preserving SSI and Medi-Cal Benefits Through an ABLE Account in California

These accounts have a lot going for them. You can learn more about all the benefits of ABLE accounts here. But one of the biggest pros by far is this. Unlike other assets or third-party support, this one doesn’t impact how much Supplemental Security Income (SSI) your loved one receives, or their eligibility for Medi-Cal health insurance.

In 2021, someone receiving the max amount only gets $950/month in California. That’s already a tragically low amount, given the cost of living the Bay Area. This isn’t a benefit you want to see cut.

In California, your loved one can only have $2000 in a regular bank account before they begin to lose needs-based benefits such as SSI and Medi-Cal. However, they can have up to $100,000 in an ABLE Account before it impacts SSI. And they can continue to receive Medi-Cal.

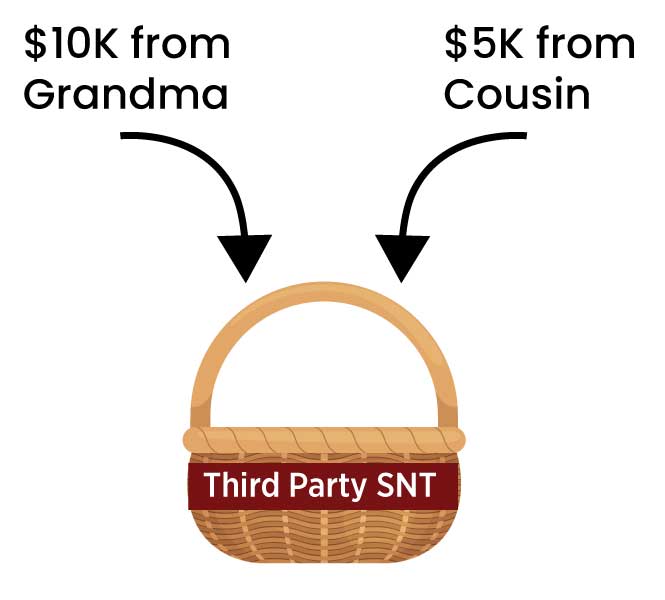

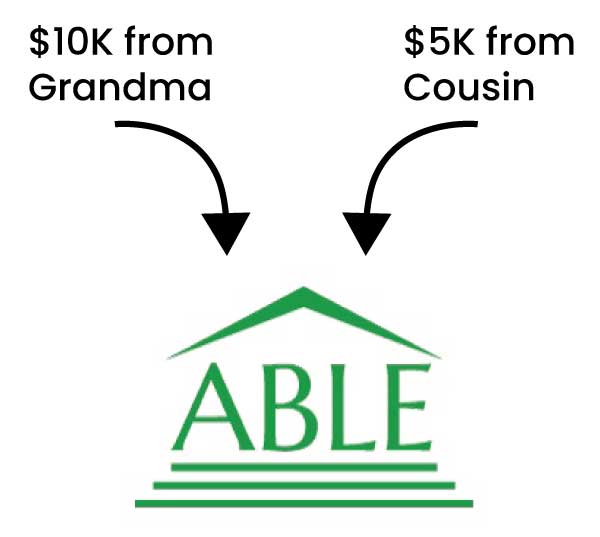

Anyone can deposit (employer, family, friend, etc.) into the account up to the total annual limit (That’s $16,000 as of 2022 plus an additional $12,760 in earned income if the owner is working).

That’s $15,000 plus an additional $12,760 if the owner works. They can get a debit card to pay for expenses from the account.

Paying with an ABLE account Vs. Special Needs Trust

Now, you may be wondering: does my loved one need an ABLE account in California if they already have Special Needs Trust?

We answer an emphatic, Yes! When paying living expenses directly from a trust versus an ABLE account, you’ll see a big difference.

Let’s say you’ve done the responsible thing and set up a special needs trust for your loved one. We congratulate you on understanding how essential SNTs are for those with special needs.

If a third party (like you) or a third-party special needs trust pays for rent and utilities, your loved one will experience an In-Kind Support and Maintenance (ISM) deduction from their SSI checks. In other words, that $950/mo will be cut by around $250.

On the other hand, let’s say you still have an SNT in place. But in addition to it, your loved one sets up an ABLE account, and the ABLE account pays these food and housing expenses instead. Your loved one continues to collect their full SSI benefit. That ~$250 can add up over time.

On top of those savings, this money grows tax-free, and when money is withdrawn no taxes are due, as long as the owner only uses funds for qualified expenses.

Get the Most with a Cal ABLE Account

Setting up an ABLE account in California for your loved one with special needs provides that person with security without missing out on key benefits. An ABLE account is one of many items that make up a solid estate plan. Understand all the elements you might need in an estate plan by reading and downloading our estate planning checklist.