ABLE Accounts

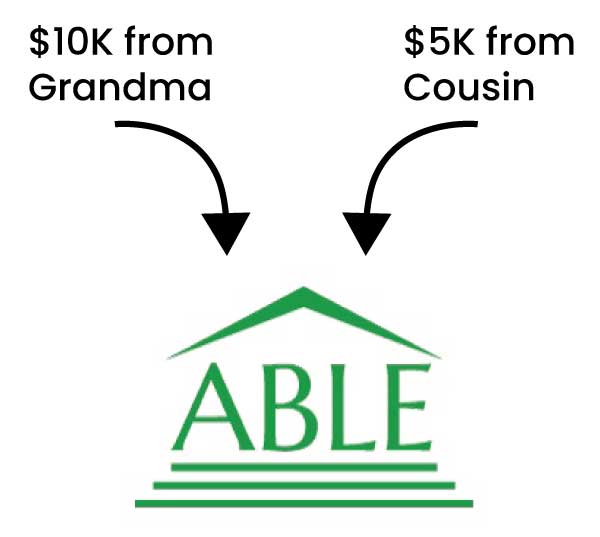

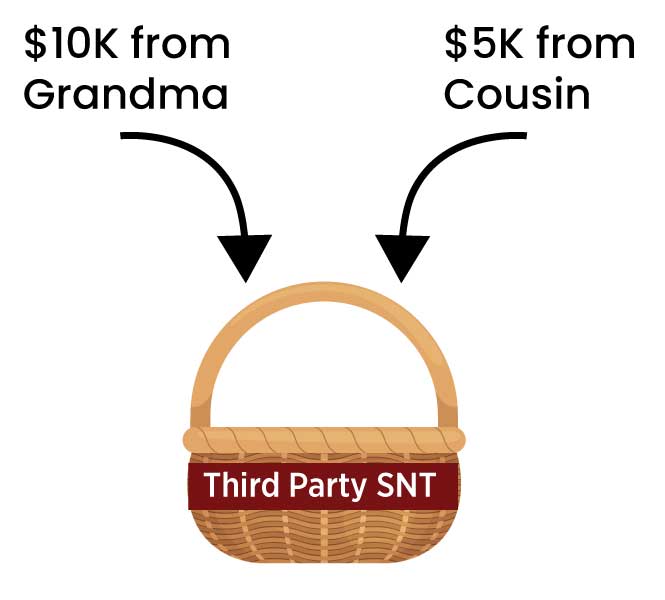

In 2015, the US Congress passed the Achieving a Better Life Experience (ABLE) Act. This act allows a disabled person to set up one savings account which does not interfere with that person’s needs-based public benefits.

At Cookman Law, we are big fans of these accounts. They allow a disabled person to save more than $2,000 without being disqualified from essential needs-based public benefits. Also, if that person is receiving SSI benefits, payments for food and housing made from an ABLE account does not decrease the SSI payment. Along with a special needs trust, these accounts can provide more financial flexibility and independence for a disabled person with capacity.

The Benefits of ABLE Accounts

While ABLE accounts offer numerous benefits, there are specific advantages for individuals living in the state of California. Not only does California have its own ABLE program, but it also has additional state-specific benefits for ABLE account holders.

programs.

used. The funds can be used to cover a wide range of qualified disability expenses, including

education, housing, transportation, healthcare, and assistive technology.

ABLE Accounts in California

In California, your account must be opened online at www.calable.ca.gov. The account holder sets up a bank account at his or her chosen bank, and then provides the account information so funds can be transferred back and forth. ABLE accounts in California require a minimum initial contribution of $25, and the account holder can receive a Visa debit card to make payments to vendors from the account. The annual fee is $37/year.

A Step Toward Independence

“Nina has had an ABLE account for several years now. We have been able to put larger gifts in, as well as recent stimulus money. With the increased balance, we branched out and split the balance between investments and regular banking. Future goals are to set up a recurring payment for rent to establish that she has resources to pay for rent, in order to increase her SSI benefit. This will be a step toward independence for Nina.”

– Connie

Comparing ABLE Account with Third Party SNT

Each offers benefits tailored to different needs in managing assets for those with disabilities. Whether securing a future with financial flexibility or providing support without affecting public benefits, understanding these options can significantly impact planning for a loved one’s well-being.

Questions |

ABLE Account |

Third Party SNT |

|---|---|---|

| Who can benefit? | Only persons disabled before age 26 | Any person with a disability |

| Who can fund? | Anyone, including beneficiary | Anyone, except beneficiary (must use first party SNT) |

| How many can person have? | One | Unlimited |

| Who inherits on death of person with disability? | Medicaid first, then to beneficiary’s heirs (no Medicaid estate recovery in VA, PA, CA) | Beneficiary’s heirs or whomever is named in document |

| How much can fund in a year? | $15,000 (or annual gift exemption) | Unlimited |

| Is funding gift-tax free? | Yes | No |

| Is there a cap in how much can be in account? | Yes, currently $100,000 limitation for SSI recipients & up to State 529-plan limitations | No |

| How is income taxed? | No income tax | Taxed as a non-grantor trust at highest marginal tax rate |

| What type of distributions can be made? | Only “qualified disability expenses” as defined by government | No limitation, except that certain disbursements may reduce or eliminate SSI or Medicaid eligibility |

Useful for Many Types of Expenses

“Our family set up an ABLE account when our son, Robbie, turned 18 so that his grandparents could gift him money each year as they do when they deposit into 529 accounts for their other grandchildren. Robbie loves respite camps, travel and has increasingly needed devices to walk and be mobile. Because of this account and our very generous family members Robbie is able to participate at Camp Krem and some wonderful travel camps as well as get a scooter to assist with his mobility. As far as we can tell, since we opened his ABLE account there are only upsides for everyone involved! “

– Beth Goddard

Preserving SSI Benefits

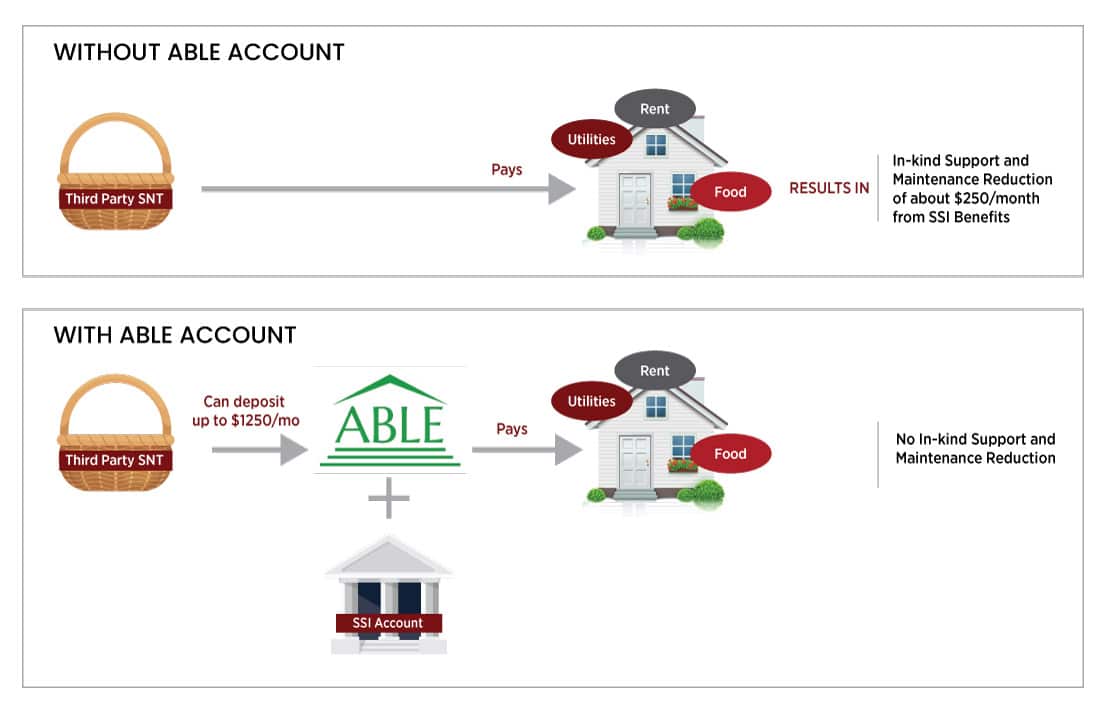

ABLE account holders can use their accounts to preserve their public benefits! Here is an example: Supplemental Security Income (SSI) is an income stream for disabled individuals that pays about $950/month in California. SSI is intended to pay the individual’s entire food and shelter costs (which is laughable, especially in California!). If another person or trust (such as a Third Party Special Needs Trust) pays for that individual’s food and/or shelter, his or her SSI monthly payment will be reduced by about $250/month; this reduction is called In-Kind Support and Maintenance, or “ISM”. To avoid incurring the ISM deduction, the other person or trust can instead make payments to the individual’s ABLE account, which counts as the individual’s own money, and then this account pays for food and shelter. In this way, the full SSI benefits are preserved! Here’s a chart showing how this works:

Gift Taxes: ABLE Accounts vs SNTs

ABLE account holders can use their accounts to preserve their public benefits! Here is an example: Supplemental Security Income (SSI) is an income stream for disabled individuals that pays about $950/month in California. SSI is intended to pay the individual’s entire food and shelter costs (which is laughable, especially in California!). If another person or trust (such as a Third Party Special Needs Trust) pays for that individual’s food and/or shelter, his or her SSI monthly payment will be reduced by about $250/month; this reduction is called In-Kind Support and Maintenance, or “ISM”. To avoid incurring the ISM deduction, the other person or trust can instead make payments to the individual’s ABLE account, which counts as the individual’s own money, and then this account pays for food and shelter. In this way, the full SSI benefits are preserved! Here’s a chart showing how this works: