If you’re a parent and a homeowner in California, Proposition 19, which is now law as of February 2021, will likely affect you.

Since Proposition 19 went into effect, I’ve been hearing from parents trying to navigate new rules and protect their child’s inheritance.

So what’s Proposition 19 all about? How will Prop 19 tax affect you and your children? Here are the Prop 19 rules you need to know about if a child or grandchild will inherit your home.

What Is Prop 19?

Prop 19 is a law that was recently passed in November 2020, and enacted in February 2021. It affects how people can pass along homes (and other real estate) to the next generation.

I hate to be the bearer of bad news. But Prop 19 has really affected a lot of people—and not for the better.

But before I talk about the detriments, there are some benefits of Prop 19 I want to discuss. These are mostly for those people who are over age 55.

But to understand Prop 19, we need to take a step back and look at a related property tax law, Proposition 13.

Prop 13 Had Some Drawbacks

Prop 13, which everyone has heard of, provides that counties in California can’t reassess your property tax value more than about one percent a year. So even if your home REALLY increases in value, you’re still paying property taxes that are pretty low based on when you bought the house, even if you made some renovations.

So for example, you might have somebody next door to you who just bought their house and they’re paying $30,000 a year of property taxes and you’re paying $3,000 a year of property taxes.

This is very common in California.

It may not be that fair, but this is what we have.

Now. What has happened recently is a lot of people have retired in California and want to downsize, so they want to move to another house. Under Prop 13, if you moved, you’d have to pay higher property taxes on property taxes based on the value of the home you purchased right now.

This has prompted an update to these rules.

Prop 19 Updates Prop 13 for the Better

All right. Now, we’re caught up to Prop 19 tax benefits. Prop 19 took Prop 13, and added some extra benefits.

So what did Proposition 19 do to benefit those who are over age 55? It allows them (and maybe this is you right now) to move to a different house. You can sell your house and move to another house of equal or greater value.

You must buy that new house within two years of selling your other home. And you must have done it after April 1, 2021, when this law went into effect.

You keep your low property tax value, which is really a great benefit. You can do this up to three times under Prop 19 rules.

But, It Has a Downside

Okay, but how do we pay for it? Isn’t that always the question?

Just like many other taxes that have been passed recently, this is being paid for by the next generation, so that’s Gen Xers and millennials right now.

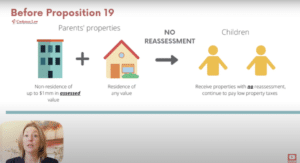

Before Prop 19, which was passed before February of 2021, if a child inherited a property from a parent, they most likely were going to keep that low property tax value.

You could leave your residence of any value to your kids. They inherit the residence and they inherit the low property tax value that you were paying.

There was no reassessment.

Also, you could leave up to $1 million of non-residence assessed value to your children and keep the same low property tax.

This was a wonderful benefit. You could pass along the property. They could inherit it. They could rent it out. Or they could live there. They could choose what they do with it and continue to pay the low property taxes.

But that was then. This is now.

Prop 19 updates this rule.

Now, if a parent leaves a house to the child, this child has to actually move in and live in that house themselves to keep the tax rates.

Honestly, as a parent and estate planning attorney, I can say, a lot of children aren’t going to do this. They’ve already set up residence somewhere else.

Even if they do move in and they make it their own property, they only get the first million dollars of increase in value excluded from reassessment.

Anything above that still gets reassessed.

Prop 19 Examples

So here’s what parents are seeing in the Palo Alto area. True story! I’m seeing a lot of people in this situation as an estate planning lawyer.

Prop 19 examples like this are popping up constantly.

Somebody bought a house for $100,000, then it’s worth $3 million when they die. The kid inherits it. Then the first million dollars of the increase in value is excluded.

Okay. So far, so good.

But they’re still going to be reassessed for almost $2 million more.

So that’s like $20,000 in taxes that they’re going to be paying every year.

Most of our kids can’t pay that! They’ll have to sell the house.

That’s why it’s important to think about how you’re transferring your assets to the next generation.

For non-residences, like rental properties, it’s even worse. There’s no exclusion from reassessment at all.

So if you have a rental property or some other business, except farmland (but that doesn’t happen that much in Silicon Valley), everything gets reassessed.

Results of Prop 19 Inheritance Property Rules

A lot of kids are now going to be selling these properties. So realtors should be happy.

In most cases, the younger generations just can’t afford to keep them and pay the higher property tax values right now. I think is really a shame.

Property taxes in California serve a purpose. And we do need to raise money in California. So there is a reason for these reassessments.

But at the same time, they will impact a lot of inheritances negatively.

This is especially hard to navigate if you were thinking your adult with special needs would inherit the house and be able to live there.

Is There a Prop 19 Loophole?

While I won’t say it’s a Prop 19 loophole, you do have more complex estate planning steps that you can take to be able to pass property along to your kids.

Some of these involve joint tenancy which is very tricky, or limited liability companies, which is also very tricky.

But here’s good news. You now know more about Proposition 19 and how that might affect California property taxes for your children. You can start thinking about how estate planning can protect your child’s inheritance.

I specialize in estate planning for complex family situations. Together, we can look to see if one of those or other approaches might need to be part of your estate plan.

I’ve prepared a webinar. It talks about the basics of estate planning, and I encourage you to take a look.

Watch the estate planning webinar now.