What is a special needs trust? Who is eligible for one? What are the different types of special needs trusts? Who can help you create one?

In this guide, I will talk about the special needs trust (SNT) and how you can protect your special needs child when you’re gone.

Who Needs a Special Needs Trust?

You have a child with special needs, and even if they’re over 18, I call them your child because they’ll always be your child. You provide for them now because they can’t fully provide for themselves—if at all. And you’re worried about what will happen when you die.

You probably want your child to inherit your money. But this isn’t the same as leaving an inheritance to one of your other children without special needs. No. This money has to last for the rest of their life. It needs to protect them. It must provide for everything they need since they probably won’t have a substantial income coming in or the ability to get more money if theirs runs out.

At the same time, depending on their abilities, they may or may not be capable of managing money, and they might be vulnerable to financial predators. Also, they might have public benefits that an inheritance could mess up.

So in this situation, I tell my clients that a special needs trust is key to meeting your goal of protecting your child when you’re gone. You don’t have to worry about what happens to your child. You can take steps now to protect your child for their lifetime. And you don’t have to be massively rich to do it. Most of my clients aren’t. I’ll show you how almost anyone can do this.

What Is a Trust?

A trust is a legally binding agreement between the person setting it up (typically the parent or grandparent) and the person managing the trust for the benefit of the beneficiary. As the person setting it up, you’re called the “Grantor” or “Settlor”. You’re granting someone else, “The Trustee”, specific permission to use the money in the trust to benefit your child.

What Is a Special Needs Trust?

What Is a Special Needs Trust?

A special needs trust is a type of trust that has a special needs individual as the beneficiary. But this isn’t just any trust with the words “special needs” plastered on it. A special needs trust must take into account 3 things that distinguish a special needs person from their peers:

- Your child may not be able to work or make enough to support themselves.

- Your child will likely qualify for benefits because of their unique needs and income level.

- The special needs trust must provide a lifetime of support.

Who is Eligible For a Special Needs Trust?

Anyone with special needs can be the beneficiary of a special needs trust. The trust recognizes that they will have specific challenges others do not. An attorney specializing in special needs estate planning can help you maximize how far the money in the trust can go.

This is critical because what is a special needs trust for? The answer: Once the parents are gone and the trust becomes active, the disabled adult may have no other means to make money or take care of themselves.

The trust must take on the role you’ve had in the child’s life while you’ve been here—at least in part.

What Can a Special Needs Trust Pay for?

What is a special needs trust paying for? Anything at all…that benefits your child.

- Food

- Housing

- Health care

- Education

- Transportation

- Fun

While it can pay for all these things, you don’t want to block public benefits that might pay for some of this. So the trust should only pay for what public benefits do not. That’s how we get that money to last.

Who Manages the Special Needs Trust?

With a third party trust (set up and funded by someone other than the disabled adult), you will probably manage the trust while you’re alive. But it’s usually not funded, so it won’t actually do anything, until you become deceased.

While you’re still around, you’ll make sure it stays up-to-date. Then, when you pass it will become active and start doing what you set it up to do.

Below, I’ll share some things you’ll need to consider when setting up an SNT.

Don’t Block Public Benefits!

Since your child has special needs, they’re more likely to qualify for public benefits that can make that trust money go further. Because of this, you don’t want to block these even if you expect the SNT to 100% take care of your child. Because you just never know what the future holds and won’t be around to make changes.

For this reason, the trust states that it kicks in after those public benefits are provided.

To make sure the trust doesn’t count as a “resource” and disqualify your child from public benefits, the child cannot manage the money. They can’t access the funds. And they can’t demand it.

As a result, it doesn’t count as their money for public benefits purposes. While this may sound restrictive, it will ensure the SNT does its job, protecting your child and helping them maintain a certain standard of living.

This doesn’t mean your child has no spending money. The SNT can buy them video games, trading cards, paint supplies, or whatever they’re into. You could even say they go to Disney World every year. And it can be flexible if their interests change.

It can even fund an ABLE account. If your child can work, they can also deposit earnings into the ABLE account. This allows them to save money without having “countable assets”, which would block benefits.

It all comes down to how we write the documents.

What Public Benefits Does a Special Needs Child Qualify for?

Now, I don’t want to rush over this topic because public benefits are critically important for most disabled adults.

I have clients with a sizeable estate of $5-10 million. But it doesn’t matter. If you have a child who just turned 18, your money is not attributable to them. They become poor (legally) because they likely have under $2,000 of countable assets.

And by setting up a special needs trust correctly, we’ve made sure they continue to have only $2000 in countable assets. You can have $5,000,000 in an SNT, and the child still continues to qualify for needs-based public benefits such as Supplemental Security Income and Medi-Cal, as long as you set it up to protect those benefits.

Compare this to giving your child an inheritance the “old-fashioned” way, directly. If that inheritance exceeds $2000, it would immediately bump them off their needs-based public benefits.

Now, something is going through Congress to increase that amount to about $8,000. And I really hope it passes but as of this article, it’s just $2,000, which is really nothing—especially in California.

Because of it, your child can qualify for an income stream and health insurance. These are the two things that the government typically provides to someone if they cannot work and support themselves.

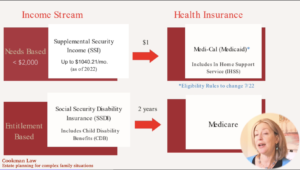

Income streams come in two forms and these influence how your child receives health coverage:

- Needs-based public benefits – Income and health insurance your child receives because they are “poor”

- Entitlement benefits – Income and health insurance based on what someone paid into the system

Needs Based Vs. Entitlement Benefits

Needs Based Benefits

So if you have under $2,000 countable assets and can’t work (or work much) because you’re disabled, you can qualify for an income stream. This is likely the case for your special needs child.

This income stream is called Supplemental Security Income or SSI. It guarantees an income of up to about $1,000 a month.

It’s intended to supplement any income your adult child is already receiving from the government or from any other sources (including earned income up to a limit).

And if you get even $1 of SSI, your child can automatically qualify for Medi-Cal, California’s version of the federal Medicaid system.

Now, Medi-Cal isn’t just medical coverage. They can also get something called in-home support services.

And this is a really important benefit that your child might need—now or as they age. Somebody’s actually being paid to provide services to your child in the house. And sometimes they’ll even pay a family member for this service.

Recent Changes in Needs Based Benefits for California

The rules on Medi-Cal just changed, and it’s really exciting.

The asset limit to get Medi-Cal has gone up from $2,000 to $130,000. And I’ve actually done a video on this. So I encourage you to watch it.

Better yet, the asset limit goes away entirely in January of 2024.At that point, just about everybody in California is going to qualify for Medi-Cal, which I think is very, very exciting.

However, Supplemental Security Income (SSI) still has an asset limit of $2,000; this probably won’t be changing anytime soon.

Entitlement Based Benefits

If somebody’s been working for a while like you or I and then we become disabled, we can get an income stream called SSDI, Supplemental Security Disability Insurance, which many people call “Disability Income”. We paid into it and it’s based on how much we worked.

We get this income stream and after about two years, we qualify for Medicare. The SSDI qualifies us for Medicare.

Medicare is excellent insurance, but some will qualify for both Medi-Cal and Medicare. When this happens, it lowers out-of-pocket medical costs because they cover different things. Additionally, Medicare normally pays 80% of covered expenses, but Medi-Cal may cover that other 20% so the insured pays nothing on some things.

Now, let’s say you recently retired. And you have a child who is disabled before age 21. They can qualify for CDB benefits. That’s Child Disability Benefits, under the SSDI umbrella.

And CDB benefits are typically half of whatever you’re receiving at the same time that you’re receiving it and then when you die, the child receives up to three-quarters.

3 Types of Special Needs Trust

Now, that we’ve answered “what is a special needs trust” and why it’s so much better than letting a special needs child inherit money directly, let’s look at the different types of trusts someone might set up for your disabled child.

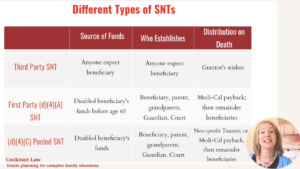

What Is a Third Party Special Needs Trust?

When someone inherits money through a trust, the disabled person should receive the inheritance into a third party trust. Someone other than the beneficiary (or spouse) set up and funded the trust. The beneficiary’s parents usually set up a third party trust. But someone else can do it, like grandma, uncle, or even a neighbor who’s always been close to the child.

They can put money, real estate, and other assets in the trust. And others can also contribute to it—crowdfunding the trust.

What Is a First Party Special Needs Trust?

A first party trust is set up by the beneficiary (or their spouse) and funded by their money. Some common sources of first party money for a special needs person are:

- Settlement funds from a lawsuit

- Inheritance

- Partial or full employment

- Money from before they became disabled

If the money remains in the beneficiary’s own name and isn’t transferred to a first party trust, it could be considered the disabled person’s own money, and that could impact their benefits.

What Is a Pooled Special Needs Trust?

A pooled trust is where a nonprofit “pools” together a lot of smaller special needs trusts, and then somebody at the non-profit manages all the money and sets up ways to make distributions. They have something called a Master Agreement, and you sign in, and then you do a Joinder Agreement.

So it’s a different way of doing things. And can be is appropriate in certain situations.

Types of Special Needs Trusts

What Type of Special Needs Trust Is Best?

Each trust can have its benefits in certain situations, so let’s look at some key differences among these trusts.

What happens to a special needs trust at death?

This depends on which type of SNT you have set up: First Party SNT, Pooled SNT, or Third Party SNT.

Medi-Cal can demand reimbursement from a First Party SNT if money remains after the disabled person dies. And they will. If anything remains, it goes to whomever the trust states.

With a pooled trust, any money remaining may go back to the non-profit, depending on the agreement. And Medi-Cal may also demand reimbursement before that money goes anywhere else. The Master Agreement outlines this.

For these reasons, a third-party special needs trust is the best for most people. Upon the disabled person’s death, all the money goes wherever you say it goes. As the person who sets up the SNT, you get to decide. So if the trust says it goes to their sibling, other family members, or charity, it goes straight there.

There’s no arguing over the disabled person’s stuff or people trying to claim it. And best of all, Medi-Cal has no claim because that was never your child’s money.

Who Sets Up a Special Needs Trust?

The beneficiary or their spouse can set up a first-party trust, as well as a parent, grandparent, or the court. BUT a first-party trust isn’t an option if the beneficiary got into a car accident after age 65. The first-party trust must be funded before the beneficiary turns 65. In this case, a pooled trust could be a viable alternative.

A Third Party Trust can be set up by just about anybody EXCEPT the beneficiary or their spouse.

When possible, I prefer third party trusts because anyone except the beneficiary can set them up and fund them: Grandpa, Auntie, and even the best neighbor ever. Medi-Cal payback doesn’t apply to this type of trust, so all the money goes where you dictate in the trust.

What Type of Attorney Sets Up A Special Needs Trust?

This is about protecting your child after you’re gone. You’re ensuring they can live a certain standard of life you want for them for their lifetime.

Regular estate planners and attorneys may or may not know enough to use the right language to set up a special needs trust. In fact, after reading this complete guide to What Is a Special Needs Trust?, you may know more about protecting benefits than they do!

But only an expert in special needs estate planning will know the ins and outs of setting up a trust, and be able to confirm that the correct language will work when you’re gone.

This is a “complex estate planning situation”. And honestly, most estate planners will not know how to deal with it. So make sure you hire a special needs attorney.

How Do I Fund a Special Needs Trust?

You don’t even have to put any money in the special needs trust while you’re alive. You can set it up to fund itself upon your death. How?

- Name it as the designated beneficiary for a retirement account.

- You, family, and friends can make it the beneficiary of one of your life insurance policies.

- Any assets in your personal, revocable trust like property investments, your private home, checking and savings accounts, etc., can go into the account after you pass.

I have one wonderful client who I recently helped set up a special needs trust. She doesn’t have a lot of money, but she has a disabled child and she was so worried about who would help them after she’s gone. She decided to get a life insurance policy to fund that special needs trust. Life insurance can be a wonderful option to fund a special needs trust when your family does not have a lot of resources.

While alive, YOU really are their “special needs trust”. You’re providing everything that they need while you’re here.

Unless you have significant disposable income, you need to be able to use your money to live your life and care for your child rather than having it sitting in a trust for an unknown amount of time.

Because what is a special needs trust for? The trust continues your work after you’re gone. Even though money can’t replace your love, it can become a surrogate caregiver because you state in the trust how that money will be used for your child’s care.

What Is a Successor Trustee?

A successor trustee is a person who becomes the manager of the trust, the trustee, after you pass on. It could be:

- Family/Friend

- Professional

- Non-profit

Most people want to name a trusted family member or friend as the trustee: little sister, your nephew who’s a CPA, a neighbor who’s always been there for you and your child.

But if you think money arguments could ruin relationships, you might not want, for example, your disabled child’s little sister making money decisions on their behalf. This, of course, depends on how agreeable your disabled child is.

You can instead choose a professional to make the financial decisions and keep those emotional bonds intact.

I usually recommend this.

The trust legally obligates the professional to manage the trust in the beneficiary’s best interest.

Setting up a professional as a successor trustee can also take a massive weight off your family, so they can continue to live their best lives without the added burden of managing money on behalf of someone else. It allows them to be the emotional support your child needs without worrying about managing money or making an accounting mistake.

What Is a Trust Protector?

If naming a stranger financially responsible for your child (or all that money) concerns you, you can name a family member as the trust protector. This person gets regular accountings from the trustee and can get rid of the trustee if they feel they’re not working in the child’s best interest. So they don’t have to manage the day-to-day stuff, but they’re still overseeing the process. Win-Win!

I have a video where I take a deep dive into choosing a successor trustee and protector. In fact, who manages the trust after you’re gone is probably the hardest decision to make.

Where Does the Money Go After They Die?

The money goes where you say it does in a third party trust, so it’s vital to think this through.

If you choose someone and that person was to die before your child, then the trust and your family may end up in probate court. That’s a hassle and costs money.

I’ll be honest; many attorneys hate going to court as much as our clients. I know I do. If we do things right outside the courtroom, we should be able to avoid probate most of the time.

For this reason, you probably shouldn’t only choose one of your siblings because if your child is in generally good health, they’re likely to outlive them.

Some possibilities include:

- Your other children

- Nieces/nephews

- The neighbor’s kids if the neighbors helped fund the trust

- Charities

Is an SNT a Standalone Document or Add-on?

A lot of people ask this. They already have a revocable trust and know the importance of estate planning. They wonder if they can just add SNT language to their trust.

Some attorneys draft it as what we call a testamentary trust (part of the revocable trust). But there are a couple of problems with that that I want to help my clients avoid.

Add-on Problem #1

Let’s say you have a grandparent or neighbor who wants to fund or leave money to the special needs trust. If that “SNT” is a testamentary trust within your revocable trust, it doesn’t “spring into being” until both parents are gone. So the grandparents can’t leave money to it in their trust or will. The SNT doesn’t exist yet. That is unless you and your spouse precede your parents, which usually isn’t the case.

On the other hand, if it’s a standalone document, anyone can put money in it at any time. It exists as soon as you set it up.

Add-on Problem #2

The second reason is even more critical—public benefits. The Social Security Administration wants to look over the trust and make sure it’s a valid special needs trust. If it’s part of a long revocable trust, they will get really confused and may conclude that it’s not a special needs trust. That could block the needs-based benefits that will help the trust support a higher standard of living than it might otherwise.

With a correctly set up standalone special needs trust, there is nothing the Social Security Administration or anyone else can dispute. That’s why working with an expert in special needs estate planning is so important.

What Is a Special Needs Trust?

A special needs trust is an important estate planning tool when you have a disabled child who may need some level of support for their lifetime. To learn more about setting one up, Watch my estate planning webinar.